Whether it’s to purchase another vehicle or pay for your schooling, debt can rapidly prompt exorbitant financing costs and difficult to-oversee month to month charges on your Visas or credits. Yet, at the same time, this can now and again be unavoidable; how you decide to deal with your debt matters.

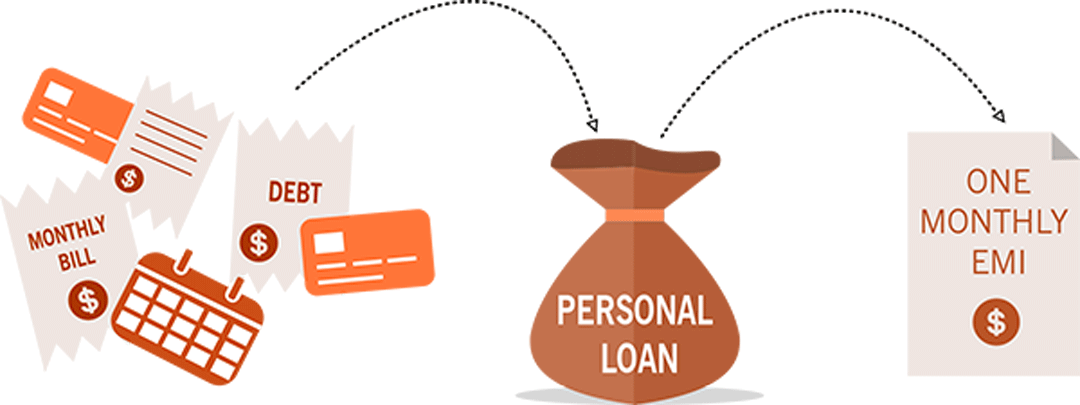

A debt consolidation loan is one technique that can make dealing with your debt far less difficult by folding all of your debt into one payment. In addition, it frequently accompanies a lower loan fee than what you were paying out every prior month while likewise giving your FICO rating a pleasant lift, among different advantages.

Key advantages of a debt union

Reimburse debt sooner

Taking out a debt combination credit might assist with putting you on a quicker track to add up to the result, particularly on the off chance that you have huge charge card debt. Visas don’t have a set course of events for taking care of equilibrium, yet a consolidation credit has fixed payments consistently with a reasonable start and end to the advance.

Work on funds

When you solidify the entirety of your debt, you never again need to stress over different due dates every month since you have one payment. Moreover, the monthly payment is a similar sum, so you know precisely how much cash to save.

Have a good reimbursement plan

If you utilize an individual credit to take care of your debt, you’ll know precisely how much is expected every month and when your absolute last payment will be. However, pay just the base with an excessive interest Mastercard, which may be a long time before you take care of it in full.

Less Stress

Merging your debt into a solitary, reasonable payment will incredibly decrease your pressure and assist with clearing up the messiness that different payments can make a lot feel. Cash matters like debt are known to prompt pressure, yet they don’t need to. By assuming command over your funds and permitting yourself to keep steady over a solitary month-to-month debt payment, you’ll clear up your psyche and wind up in a superior monetary position.

Help credit

While a personal loan consolidation credit may at first lower your FICO rating somewhat since you’ll need to go through a hard credit request, it will probably work on your score over the long run. That is because it’ll be more straightforward to make on-time payments. Your payment history represents 35% of your FICO rating, so taking care of a solitary month-to-month bill when it’s expected ought to essentially raise your score.